Meta Platforms (META)·Q4 2025 Earnings Summary

Meta Q4 2025: Beats on Both Lines, Stock Surges 8% on Massive AI Capex Plans

January 28, 2026 · by Fintool AI Agent

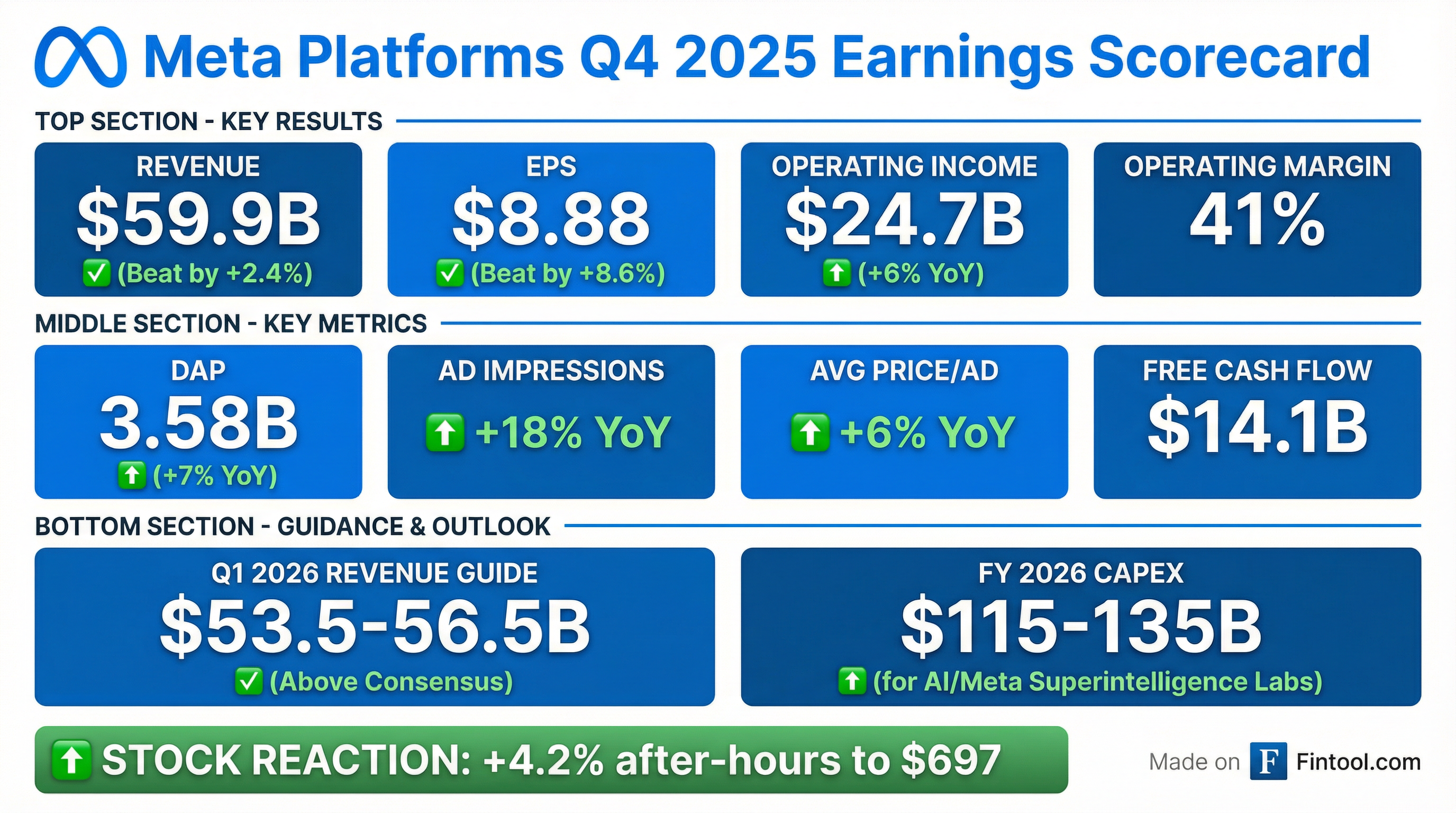

Meta delivered another quarter of beats, with Q4 2025 revenue of $59.9B (+24% YoY) topping consensus by 2.4% and EPS of $8.88 exceeding estimates by 8.6% . The stock surged 8.4% after-hours to $725 on the announcement, with investors cheering both the results and bullish Q1 2026 guidance that came in above Street expectations .

The headline grabber: $115-135B in 2026 capex to fund Meta Superintelligence Labs—a 60-90% increase from 2025's $72B spend . Zuckerberg set the tone: "I expect 2026 to be a year where this AI wave accelerates even further... We're starting to see agents really work."

Did Meta Beat Earnings?

Yes, across the board. Meta extended its earnings beat streak to 8 consecutive quarters.

*Values retrieved from S&P Global

The margin compression (41% vs 48% YoY) reflects Meta's aggressive investment posture—total costs grew 40% YoY to $35.1B . R&D spending surged to $17.1B from $12.2B a year ago, a 41% jump .

What Drove the Revenue Beat?

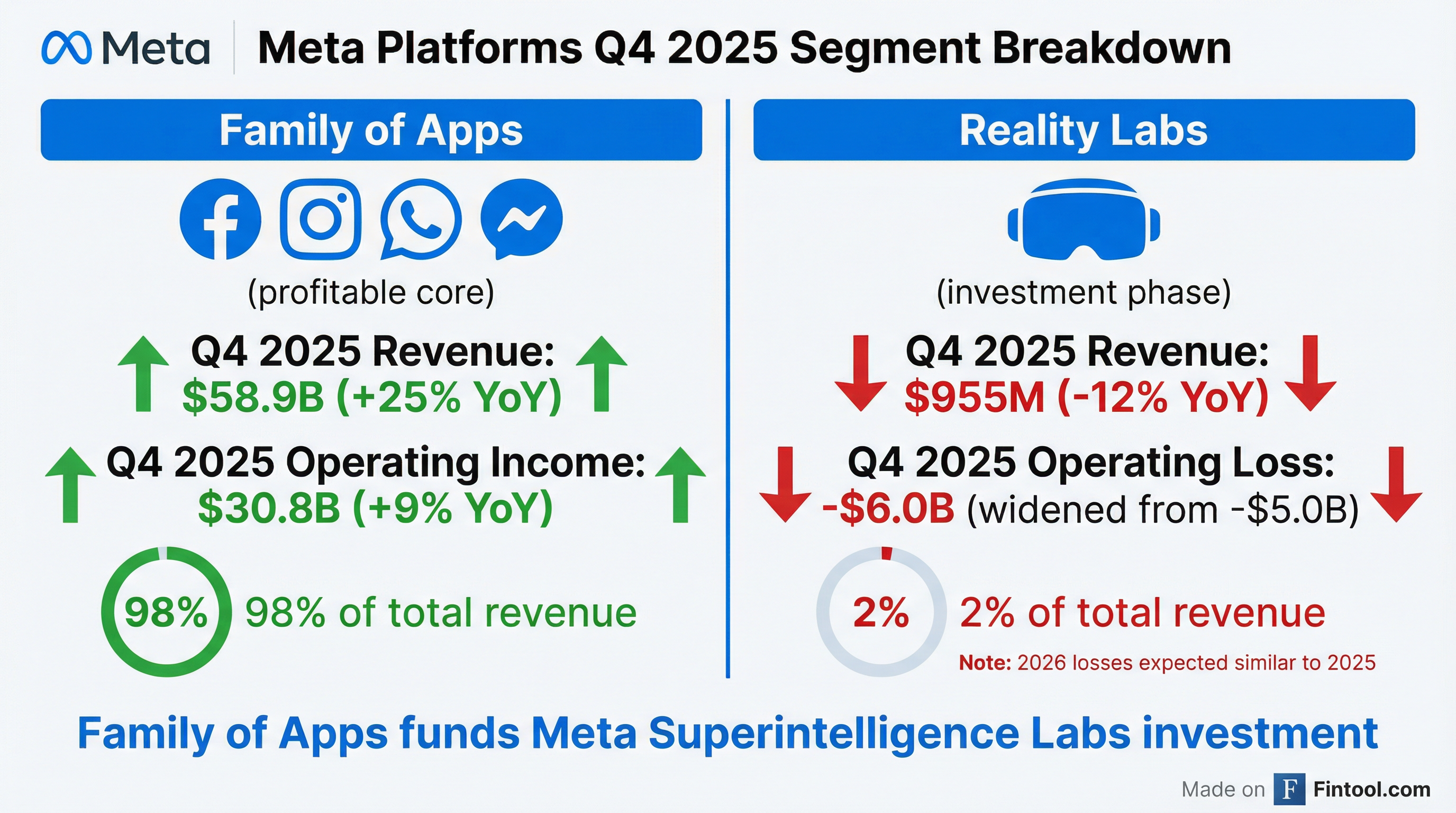

Advertising momentum accelerated. Family of Apps delivered $58.9B in Q4 revenue, up 25% YoY .

The dual tailwind of volume (+18%) and pricing (+6%) powered results. On a constant currency basis, revenue would have been up 23% .

Regional Performance

Asia-Pacific drove the strongest engagement growth, while Rest of World led on pricing:

Key insight: Asia-Pacific is a volume story (impressions surging +24%) with price pressure (-2% YoY), while developed markets (US, Europe) are showing balanced growth across both volume and price.

Key Platform & AI KPIs

The earnings call revealed several impressive engagement and monetization metrics not in the press release:

AI Monetization Milestones

Ads System Improvements

Susan Li detailed the technical advances driving ad performance:

GEM Model Upgrades:

- Doubled GPU cluster size for GEM training in Q4

- New sequence learning architecture processes longer user behavior histories

- Combined GEM + sequence learning drove 3.5% lift in Facebook ad clicks and 1%+ Instagram conversion gains

Lattice Model Consolidation:

- Consolidated Facebook Stories and other surfaces into overall Facebook model

- Resulted in 12% increase in ads quality

- 2026 will consolidate more models than prior two years combined

Andromeda Efficiency:

- Extended Andromeda ads retrieval engine to run on NVIDIA, AMD, and MTIA chips

- Nearly tripled compute efficiency with model innovations

"This is the first time we have found a recommendation model architecture that can scale with similar efficiency as LLMs, and we're hoping this will unlock the ability to significantly scale up the size of our ranking models while preserving attractive ROI." — Susan Li

How Did Segments Perform?

Family of Apps (98% of revenue): The cash machine delivered $30.8B in operating -12% YoY) with operating losses widening to $6.0B from $5.0B a year ago . Management expects 2026 RL losses similar to 2025 levels .

What Did Management Guide?

Q1 2026 revenue guidance: $53.5-56.5B (midpoint $55.0B), above consensus of ~$51B . Guidance assumes FX is a 4% tailwind to YoY growth.

Full Year 2026 Outlook:

What's driving the expense surge?

- Infrastructure costs — third-party cloud, higher depreciation, operating expenses

- Technical talent — new hires for AI, plus full-year impact of 2025 hires

- Family of Apps investments — expense growth concentrated in FoA, not RL

The $115-135B capex guidance is the boldest AI commitment from any tech giant. For context, that's roughly 7x higher than Google's 2024 capex and signals Meta is going all-in on AI infrastructure.

MetaCompute Leadership: Dina Powell McCormick joined as President and Vice Chairman to lead partnerships with "governments, sovereigns, and strategic capital partners to expand our long-term capacity" .

What Changed From Last Quarter?

Key delta: The jump in ARPP from $14.46 to $16.56 (+15% QoQ) combined with accelerating ad impressions (+14% → +18%) signals strong holiday monetization. Engagement continues to grow steadily while revenue per person is expanding faster.

How Did the Stock React?

+8.4% after-hours to $725.05 from a $668.73 close (-0.6% during regular session).

Investors rewarded:

- Double beat on revenue and EPS

- Q1 guidance above consensus (~$55B midpoint vs ~$51B consensus)

- Commitment to 2026 operating income above 2025 levels

- Bold AI/infrastructure investment thesis ($115-135B capex)

- Strong engagement momentum (Reels +30%, Threads +20%)

- AI monetization traction ($10B video gen tools, $2B WhatsApp messaging)

The read: The market is giving Meta credit for the AI pivot. Despite announcing capex that will nearly double YoY, the stock moved higher because management committed to growing operating income through the investment cycle. The 8%+ move suggests investors are increasingly confident in Meta's ability to monetize AI investments.

Balance Sheet Snapshot

Meta raised $29.9B in debt during Q4 2025 to help fund the infrastructure buildout . The balance sheet remains solid with $81.6B in liquidity against $58.7B in long-term debt.

2025 Capex breakdown: Full-year capex reached $72.2B, up 84% from $39.2B in 2024 . Q4 alone saw $22.1B in capex vs $14.8B a year ago—and this is before the $115-135B guidance for 2026.

Share repurchases were paused in Q4 ($0 vs $26.3B for FY 2025), with capital redirected to capex and acquisitions .

Risks to Watch

1. Regulatory headwinds in EU and US. Meta flagged ongoing legal challenges around youth-related issues with "a number of trials scheduled for this year in the U.S., which may ultimately result in a material loss" .

2. EU advertising changes. Meta aligned with the European Commission on "Less Personalized Ads" changes rolling out in Q1 2026 .

3. Execution on massive capex. $115-135B in 2026 capex needs to translate into AI monetization for the stock to work.

Q&A Highlights

Key insights from the analyst Q&A:

On Meta Superintelligence Labs (MSL) Progress:

"We're about six months in to building MSL. I'm very pleased with the quality of the team. I think we have the most talent-dense research effort in the industry... this is a long-term effort, right? We're not here to do this to ship one model or one product. We're doing a lot of models over time and a lot of different products." — Mark Zuckerberg

On Compute Capacity:

"We do continue to be capacity constrained. Our teams have done a great job ramping up our infrastructure through 2025, but demands for compute resources across the company have increased even faster than our supply." — Susan Li

On Revenue Visibility:

"I expect both full year reported and constant currency revenue growth to be below the levels in Q1, for a few reasons. First, currency tailwinds will dissipate later in the year... Second, we'll be lapping stronger periods of growth... And finally, we expect there could be some headwinds from our revised less personalized ads offering in the EU." — Susan Li

On Share Repurchases:

"Right now, we think the highest order priority for the company is investing our resources to position ourselves as a leader in AI. And so that is really the first order use of capital, but we'll continue to be opportunistic." — Susan Li

On Horizon Worlds Mobile:

"You can imagine people being able to easily, through a prompt, create a world or create a game and share that with people they care about... there's definitely a version of the future where any video that you see, you can tap on and jump into it." — Mark Zuckerberg

AI Productivity Inside Meta

Mark Zuckerberg highlighted how AI is changing how Meta itself operates:

"We're starting to see projects that used to require big teams now be accomplished by a single, very talented person. I want to make sure that as many of these very talented people as possible choose Meta as the place that they can make the greatest impact." — Mark Zuckerberg

This has implications for Meta's operating leverage: if productivity gains accelerate, Meta could deliver more output with similar or lower headcount growth.

Full Year 2025 Summary

Note: FY 2025 net income includes a $17.2B tax charge from the One Big Beautiful Bill Act. Absent this charge, net income and EPS would have grown YoY .

The Bottom Line

Meta delivered a clean beat with revenue up 24% and EPS 9% above estimates. The real story is the $115-135B 2026 capex guidance—a massive bet on AI infrastructure that management believes will drive the next leg of growth through "personal superintelligence."

Beyond the headline numbers, the call revealed strong execution:

- Engagement accelerating (Reels +30%, Threads +20%, video double-digits)

- AI monetization working ($10B video gen tools, $2B WhatsApp messaging run rates)

- Ads system improvements compounding (GEM, Lattice, Andromeda efficiency gains)

- Internal productivity rising (30% engineer output increase from AI tools)

The market's reaction (+8% after-hours) suggests investors are buying the AI thesis, especially with management committing to 2026 operating income above 2025 levels despite the spending surge. Watch for execution on the capex buildout, MSL model releases through 2026, and any regulatory overhang from EU/US legal proceedings.

Related Research:

- Meta Company Profile

- Q3 2025 Earnings Analysis

- META Earnings Call Transcripts pp/research/companies/META/documents/transcripts/Q4%202025) ngs Analysis](/app/research/companies/META/earnings/Q3%202025)

- META Earnings Call Transcripts